- +1 (800) 895-8603

Protect Your Wealth with

Long-Term Stability

A Precious Metals IRA provides a tax-advantaged way to grow and preserve your assets over time. By incorporating physical metals into your retirement strategy, you gain a secure foundation that complements traditional paper investments and enhances portfolio diversification.

Diversify Smarter. Retire Stronger.

What Is a Metals IRA?

A Gold IRA, also known as a Precious Metals IRA or Self-Directed Gold IRA, is a retirement account that allows you to hold physical gold and other IRS-approved metals instead of traditional paper assets like stocks or bonds. These accounts offer the same tax advantages as a traditional or Roth IRA, with the added benefit of portfolio diversification and protection against inflation.

Your metals are stored securely in an IRS-approved, insured depository, giving you peace of mind while building long-term wealth with tangible assets.

Ready to get started?

Contact us today for a free consultation.

Diversify Smarter. Retire Stronger.

Get Started Today

Connect with us to schedule a call and simplify the setup process for your Gold IRA.

Three Simple Steps to Start Your Gold IRA Today

Starting your Gold IRA is easier than you think. Follow these three simple steps to secure your financial future with precious metals. Take control of your retirement savings today!

Step 1: Open Your IRA with a Custodian

Work with an IRS-approved self-directed IRA custodian to set up your Precious Metals IRA. This account will allow you to hold physical gold and other qualifying metals within your retirement plan.

Step 2: Fund Your Account

You can fund your new IRA through a transfer, rollover from an existing retirement account, or a direct contribution. Your custodian will guide you through the best option based on your goals.

Step 3: Purchase IRA Approved Precious Metals

Once your account is funded, it’s time to choose your metals. Select from a range of IRS-approved gold, silver, platinum, or palladium products. Your metals are then securely stored in a regulated depository on your behalf.

Custodians We Work With and Trust

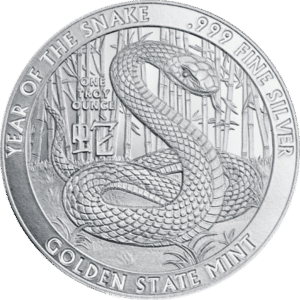

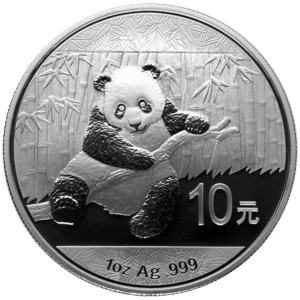

Our Most Popular

IRA Approved Products

Shop approved products to add to your IRA

Investing in a Precious Metals IRA can be a prudent strategy for long-term wealth preservation. These accounts offer portfolio diversification by including assets that often behave differently than traditional equities or bonds. Precious metals like gold and silver have historically served as a buffer against inflation, maintaining their value when paper currency declines. Moreover, the tangible nature of these assets provides an added sense of security and potential upside during times of economic uncertainty.

When investing through a Precious Metals IRA, the metals are not delivered to you personally. Instead, IRS regulations require that the assets be securely stored in an approved depository. This ensures compliance with tax laws while maintaining the physical integrity of your investment.

Yes, you can choose to take delivery of your metals. However, doing so constitutes a distribution from your IRA and may result in tax consequences. It’s wise to consult with a qualified tax advisor before initiating any withdrawal.

Once your funds clear, your metals typically ship within 1–3 business days. Delivery to the depository can take another 1–5 business days depending on shipping logistics. After arrival, it may take a couple of additional days for the holdings to be recorded in your account.

Absolutely. From the moment your metals are shipped to the time they are held in storage, they are fully insured. Your IRA custodian and storage facility ensure comprehensive protection for your investment.

Only certain bullion products meet the IRS criteria for IRA inclusion:

- Gold: Minimum 99.5% purity

- Silver: Minimum 99.9% purity

- Platinum and

- Palladium: Minimum 99.95% purity

Notably, American Gold Eagles are permitted despite being slightly below this threshold. Coins such as pre-1933 gold, Krugerrands, and 90% silver U.S. coinage are generally excluded.

All of our approved third party depositories offer detailed reporting and secure record keeping. You can expect routine account statements and full transparency, ensuring peace of mind.

Startup fees are usually modest. Storage and custodian fees vary by provider, but many firms offer promotional rates for new clients. It’s advisable to inquire directly to get a clear picture of potential costs and available incentives.

Yes. Funds from an existing IRA can be transferred or rolled over into a self-directed IRA that accommodates physical precious metals. Your custodian will guide you through the process.

The duration depends on your current custodian. Setting up a new account can take a day or two after your application is submitted, while the funding process might range from a few days to a couple of weeks depending on inter-custodian transfers.

Yes, you may maintain more than one IRA. However, your total annual contribution limit applies across all accounts combined, not to each account individually.

Yes, contribution limits are imposed annually and depend on your income and the type of IRA you hold. For current thresholds and guidance, it’s best to consult with a financial advisor or your IRA custodian.

You can begin taking distributions from your Precious Metals IRA without penalty at age 59½. These withdrawals may still be subject to taxation unless taken from a Roth IRA.

You can open a Precious Metals IRA if you are under 70½ and have earned income. This aligns with general IRA eligibility rules.

Many custodians, including FMR Gold, do not impose a minimum purchase requirement for IRA investments. This makes entry accessible to a wide range of investors.

At a minimum, you’ll need to complete an application and provide valid identification, such as a driver’s license. Additional forms may be necessary if you’re funding the account through a rollover or transfer.

Not at all. The process is straightforward, particularly with the assistance of your IRA custodian or advisor. Most firms provide personalized support to ensure the transition is smooth and clear.

Yes, ongoing contributions are allowed within annual limits. Funds can either remain in cash within your account or be used to acquire additional precious metals as part of your investment strategy.

Traditional brokerage firms typically deal in financial instruments like stocks and bonds. Physical assets, such as precious metals, require a Self-Directed IRA managed by a custodian that can facilitate secure storage and compliance with IRS regulations. Transitioning to such a structure is essential if you wish to include physical metals in your retirement plan.