Charts

Precious Metals

Live Spot Price Charts

Understanding the Spot Price: An In-Depth Guide to Gold, Silver, Platinum and Palladium

As an astute investor, you must have noticed that precious metals like gold, silver, platinum, and palladium have steadily increased in value over time, making them a reliable investment option. This article aims to delve deep into the concept of spot prices for these precious metals, elaborate on their historical significance, discuss different types of physical precious metal forms, and provide insights into the dealer premiums.

What is a Spot Price?

Spot Price is a term used in financial markets that refers to the immediate settlement price of a commodity or a security. In the context of precious metals, spot price refers to the current market price at which these metals can be bought or sold for immediate payment and delivery. It serves as a benchmark for dealers to set their premium prices for precious metals transactions.

The Historical Significance of Precious Metal Investing

Investing in precious metals has a rich historical significance. For centuries, societies across the globe have valued precious metals, using them as a form of currency, a symbol of wealth, and a solid investment. Over time, precious metals have consistently held their value, even amidst economic instability, making them a favored investment choice for those looking to guard against the ongoing devaluation of fiat currencies and volatility in the stock market.

Different Types of Physical Precious Metal Forms

When it comes to investing in physical precious metals, you have a range of options at your disposal:

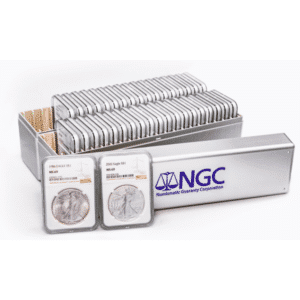

Gold and Silver Bullion Products

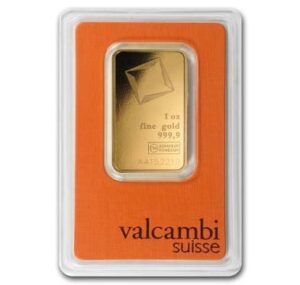

Bullion refers to precious metals in bulk form, which are traded on commodity markets. Gold and silver bullion products come in various forms including coins, bars, and rounds.

- Coins: Coins like the Silver American Eagle and the Canadian Maple Leaf are popular choices for investors. These are minted and supported by a government, giving them a face value and a guarantee of their metal content.

- Bars: If you’re looking for larger quantities of precious metal, bars are the way to go. They often carry lower premiums than coins, making them a more cost-effective option.

- Rounds: Rounds are similar to coins in appearance but are not backed by a government. They are minted by private organizations and usually carry lower premiums than coins.

Paper Silver: The Silver Spot Price

Apart from physical bullion, paper silver is another investment option. This includes Exchange-Traded Funds (ETFs) and certificates, which are essentially documents certifying that a bank or financial institution is holding a specified amount of silver on your behalf. This form of investment doesn’t involve physically handling the silver, making it a convenient choice for some investors.

Spot Price Fluctuations: The Ever-Changing Nature of the Market

Spot prices for precious metals are subject to frequent changes based on market conditions. Various factors influence these fluctuations, including supply and demand, geopolitical events, and economic indicators. It’s crucial for investors to monitor these changes to make informed investment decisions.

Understanding Bid/Ask in Precious Metals Trading

When dealing in precious metals, you’ll often come across the terms ‘bid’ and ‘ask’. The ‘bid’ price refers to the maximum amount a buyer is willing to pay for a precious metal, while the ‘ask’ price is the minimum amount a seller is willing to accept for it. The difference between the bid and ask price, known as the spread, can indicate the liquidity and volatility of the market. A narrow spread suggests a more stable market, while a wide spread could indicate higher volatility.

Silver Futures Contracts and Precious Metal Exchanges

A silver futures contract is an agreement to buy or sell a specific amount of silver at a predetermined price at a set date in the future. These contracts are traded on precious metal exchanges, with COMEX (Commodity Exchange) and NYMEX (New York Mercantile Exchange) being prominent ones. These exchanges allow investors to speculate on the future price of silver, providing opportunities for substantial gains.

The Gold/Silver Ratio

The gold/silver ratio is a measure of how many ounces of silver it takes to buy one ounce of gold. This ratio is used by investors to determine the relative value of these two precious metals and to identify potential investment opportunities.

Taxation of Physical Silver in the USA

In the United States, physical silver is subject to capital gains tax. The rate of tax depends on your tax bracket and the length of time you hold the asset. FMR Gold does not provide tax advisory services. We recommend consulting your personal accountant or tax advisor for accurate information regarding your tax bracket and potential tax implications related to the sale of precious metals

Dealer Premiums and their Importance

When buying precious metals, you are likely to encounter dealer premiums. These are additional costs over the spot price and account for factors like manufacturing, storage, and transportation of the metals. Understanding these premiums can help you make informed investment decisions.

The Final Verdict: Bars vs Coins

When it comes to choosing between bars and coins, it largely depends on your investment goals. If you’re seeking lower premiums and larger quantities, bars are an ideal choice. On the other hand, if you value design and collectability, coins might be more suitable.

FAQs on Spot Prices and Precious Metals Investing

Below are answers to some common questions related to spot prices and precious metals investing:

What are the different types of gold and silver bullion products?

Gold and silver bullion products come in various forms, including coins, bars, and rounds. Each of these forms has its unique advantages. Coins are often valued for their design and collectability, while bars are preferred for their lower premiums and larger quantities. Rounds, similar to coins in appearance, are usually minted by private organizations and carry lower premiums than coins.

Why can’t I buy gold and silver at the spot price?

When you buy gold and silver, you are required to pay a dealer premium in addition to the spot price. This premium covers the costs related to manufacturing, storing, and transporting the precious metals. It may also include a profit margin for the dealer.

What is the difference between the bid and the ask price?

In precious metals trading, the ‘bid’ price is the maximum amount a buyer is willing to pay for the metal, while the ‘ask’ price is the minimum amount a seller is willing to accept for it. The difference between these two prices is known as the spread.

How often do spot prices change?

Spot prices for precious metals change frequently based on various market conditions, including supply and demand, geopolitical events, and economic indicators. It’s crucial for investors to stay updated on these changes to make informed investment decisions.

What is a silver futures contract?

A silver futures contract is an agreement to buy or sell a specific amount of silver at a predetermined price at a set date in the future. These contracts are traded on precious metal exchanges and allow investors to speculate on the future price of silver.

What is the COMEX?

The COMEX (Commodity Exchange) is a leading precious metal exchange where commodities like gold, silver, copper, and aluminum are traded. It’s a platform for investors to trade futures contracts and options.

What is the NYMEX?

The NYMEX (New York Mercantile Exchange) is a commodity futures exchange where energy products and precious metals are traded. It’s a subsidiary of the Chicago Mercantile Exchange (CME) and is one of the largest futures and options trading exchanges in the world.

How big are silver futures contracts?

A standard silver futures contract on the COMEX is for 5,000 troy ounces of silver. However, there are also mini contracts available for 1,000 troy ounces.

Is it possible to take delivery of a futures contract?

Yes, it is possible to take delivery of a futures contract at the expiration of the contract. However, most traders prefer to settle their contracts in cash rather than take physical delivery of the commodity.

What is the gold/silver ratio?

The gold/silver ratio is a measure of how many ounces of silver it takes to buy one ounce of gold. It’s used by investors to determine the relative value of these two precious metals and to identify potential investment opportunities.

Is physical silver taxed in the USA?

Yes, physical silver is taxed in the USA. It’s subject to capital gains tax, and the rate depends on your tax bracket and how long you hold the asset.

Are silver bars cheaper than silver coins?

Generally, silver bars carry lower premiums than silver coins and are therefore cheaper on a per-ounce basis. However, coins may offer additional value in terms of design and collectability.

Should I buy gold or silver?

Investing in precious metals can be a great way to hedge against economic uncertainties and preserve wealth. Understanding spot prices and how they work is a crucial part of this investment journey. Whether you choose to invest in gold, silver, platinum, or palladium, keeping a close eye on the spot price and other market indicators can help you make informed decisions and maximize your returns.